|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mechanical breakdowns in your vehicle can be both frustrating and costly. Fortunately, there's a solution to protect yourself from unexpected repair expenses: Mechanical Breakdown Coverage. In this article, we'll delve into the details of this coverage, its benefits, and why it's a smart choice for vehicle owners. Understanding Mechanical Breakdown Coverage:Mechanical Breakdown Coverage, often referred to as an extended warranty or vehicle service contract, is an insurance policy that covers the repair costs of major vehicle components when they break down due to mechanical failures. It provides an extra layer of protection beyond your standard manufacturer's warranty. Benefits of Mechanical Breakdown Coverage:Investing in Mechanical Breakdown Coverage offers several advantages:

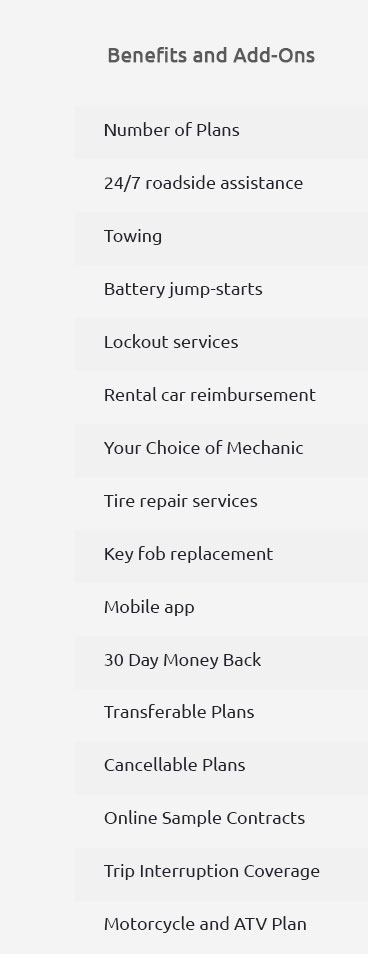

How Mechanical Breakdown Coverage Works:When you purchase Mechanical Breakdown Coverage, you'll typically need to pay a premium, either as a one-time payment or in installments. In return, you'll receive coverage for specific vehicle components for a predetermined period or mileage limit. If a covered component breaks down due to mechanical failure during the coverage period, the policy will pay for the cost of repairs, minus any applicable deductible. Choosing the Right Mechanical Breakdown Coverage:To make the most of Mechanical Breakdown Coverage, consider these factors when selecting a plan:

Conclusion:Mechanical Breakdown Coverage is a valuable investment for vehicle owners looking to safeguard their finances from unexpected repair costs. With its cost-saving benefits, peace of mind, and potential to extend your vehicle's lifespan, it's a smart choice. Make sure to research and select the right coverage plan that suits your vehicle and budget, ensuring worry-free driving for years to come. |

|---|

|

|